KEY INSIGHTS –JUNE 2025

● Ghana’s Economy Expands by 5.3% in Q1 2025

Ghana’s GDP grew by 5.3% year-on-year in Q1 2025, up from 3.6% in the previous quarter. Growth was driven by a 5.6% increase in gold production, a 6.6% rebound in agriculture—especially cocoa—and steady expansion in the services sector at 5.9%.

● Inflation Drops to 13.7% y-o-y in June, Lowest Since 2021

Ghana's annual consumer inflation eased for the 6th month running in June, hitting 13.7%, the lowest level since December 2021. This is a 470 basis points decrease compared to 18.4% in June 2025.

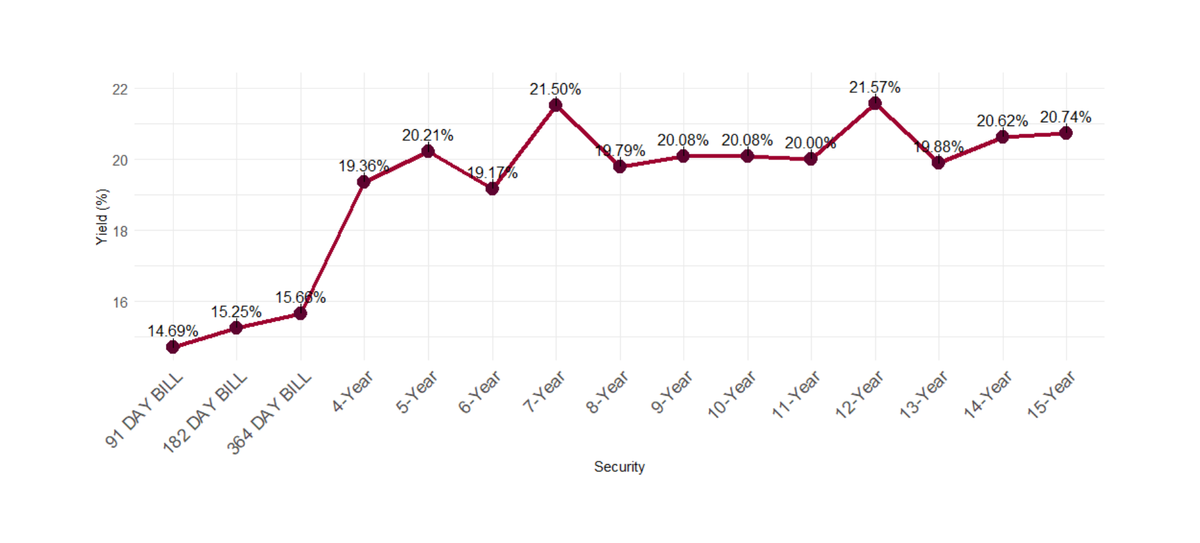

● Treasury Bill Yields Decline Across All Tenors

Yields on Ghana’s short-term government securities declined, with the 91-day bill dropping to 14.69%, the 182-day to 15.25%, and the 364-day to 15.65%, reflecting lower borrowing costs and improved market sentiment.

● Bond Yields Drop Sharply in June

Most GoG bond yields fell in June compared to May, led by significant declines in the 6-year (-180 bps), 4-year (-156 bps), and 8-year (-143 bps) tenors. Only the 7-year and 11-year bonds saw marginal increases of 36 and 4 basis points, respectively.

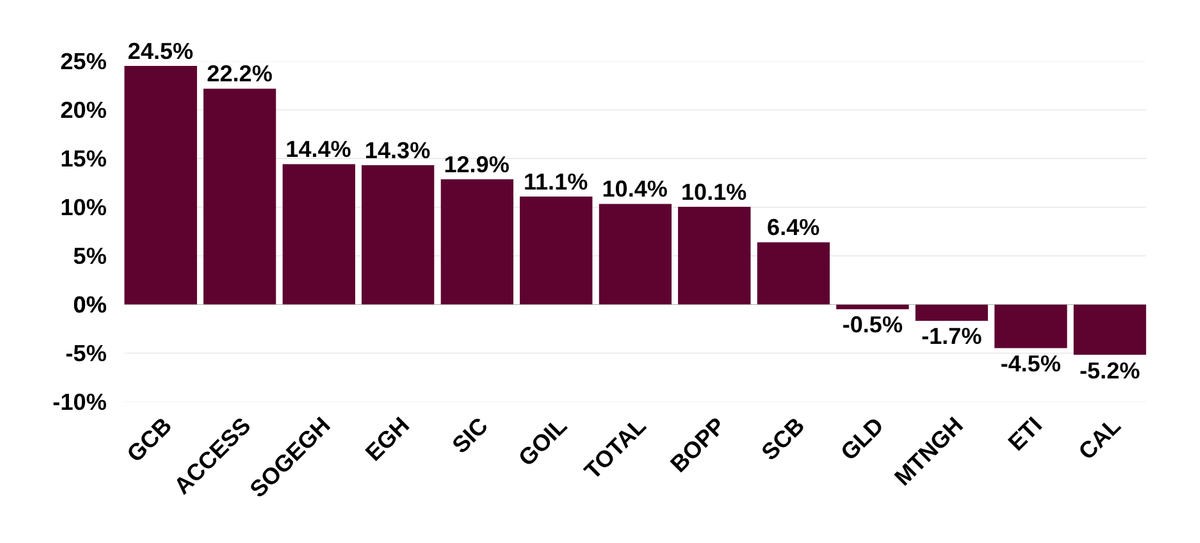

● GSE Indices Post Modest Gains in June

The Ghana Stock Exchange Composite Index rose by 1.60% in June, while the Financial Stocks Index recorded a stronger gain of 4.94%, supported by positive movements in key banking stocks. GCB Bank (+24.53%), Access Bank (+22.19%), and Societe Generale Ghana (+14.44%) led the list of top performers on the local bourse, while CalBank (-5.17%) posted the steepest decline.

PRIMARY DEBT MARKET ISSUANCE

The Government of Ghana's (GoG) Treasury bill interest rates posted bearish performance across all tenors in June 2025 as shown in the table below.

| Security | Last% | Previous% | Basis Points |

|---|---|---|---|

| 91-Day GoG Bill | 14.6938 | 14.9287 | ▼ 23.49 |

| 182-Day GoG Bill | 15.2506 | 15.5515 | ▼ 30.09 |

| 364-Day GoG Bill | 15.6564 | 16.0012 | ▼ 34.48 |

Source(s): Bank of Ghana

GHANA FIXED INCOME MARKET VOLUME TRADED

The Ghana Fixed Income Market (GFIM) saw a declined in activity, with total trades easing by 72%% to reach 9,681 transactions. The total traded volume also dipped by 41%, amounting to GH₵10.64 billion compared to the GH₵17.99 billion posted in May 2025. Trading activity on the GFIM started strong in June, recording the highest weekly volume of GH₵3.12 billion in the first week (the 23rd week of the year). However, volumes declined significantly over the month, falling to GH₵2.07 billion by the final week.

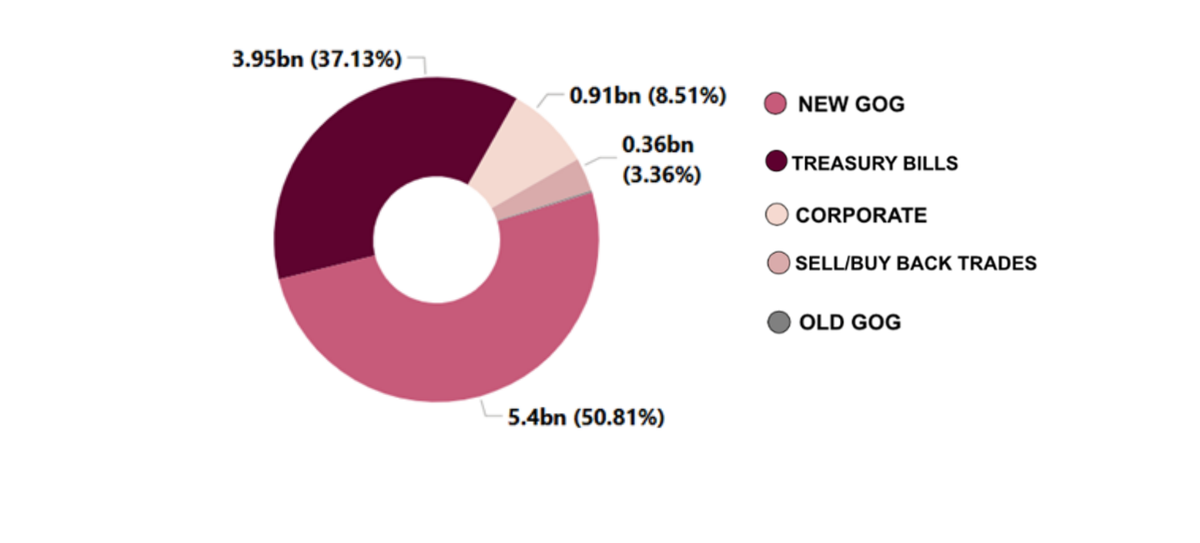

Total Traded Volume by Security

Treasury bills dominated the trading landscape in terms of number of trades, accounting for a significant 94.13% (9,113) of total trades, 73% decrease compared to the 33,509 total trades posted in May 2025. However, New Government of Ghana Bonds dominated in terms of value of trades, accounting for 50.81% of total value of trades.

Yield Curve –June 2025

EQUITY MARKET

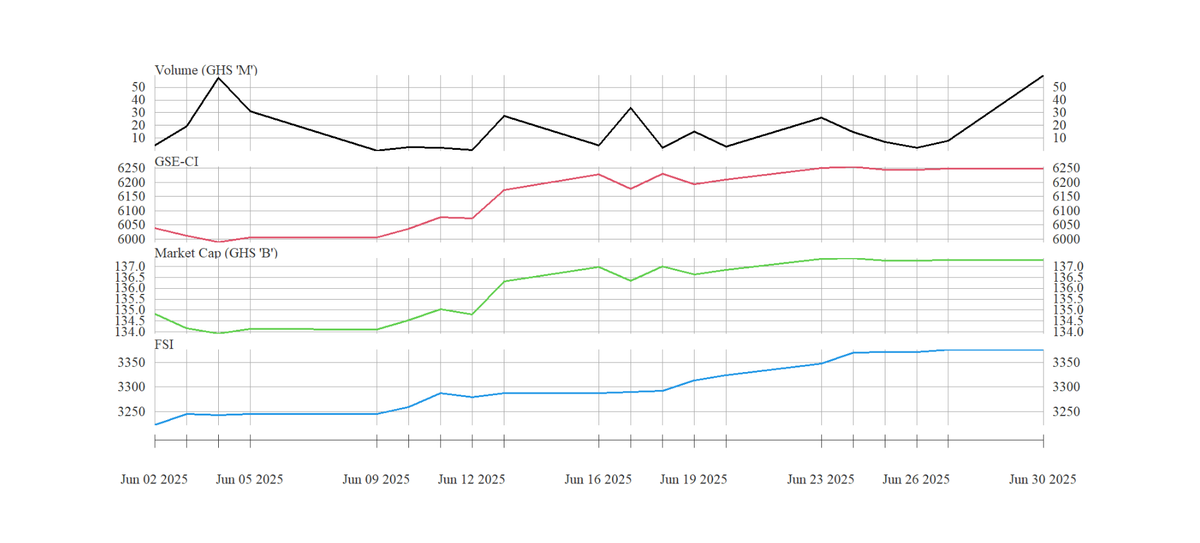

Trading activity on the local exchange saw a total of 25,132,689 shares traded in June, valued at approximately GH₵109.59 million. This represents a 27% decline in volume compared to May’s 34,534,543 shares. The total value of trades also declined from GH₵144.18 million recorded in May. Meanwhile, market capitalization rose marginally by 0.54%, increasing from GH₵136.55 billion to GH₵137.29 billion.

Daily Total Shares Traded, Ghana Stock Exchange Composite Index (GSE-CI), Market Cap GHS (B), and Financial Stock Index (FSI)

Monthly Gainers & Laggards

COMMODITY MARKET

The commodity market had a mixed performance in June. Brent crude oil experienced moderate fluctuations, starting at $66.62 per barrel, surged to $76.70, and closing at $67.61, marking a 5.81% monthly gain amid shifting supply-demand dynamics.

Gold posted significant volatility from a softer US dollar, peaked at $3,431.2, rallying from $3,288.9/t.oz to $3,288.9/t.oz, posting a 0.17% marginal gain as investors sought safe-haven assets.

Cocoa prices exhibited significant volatility, starting at approximately $9,474 per tonne, the price fluctuated considerably, reaching a high of about $10,174 around mid-June before dipping back to $9,356 by the end of the month, showing a 4.44% loss month-on-month.

Source(s): Bank of Ghana