KEY HEADLINES & INSIGHTS

Ghana’s GDP Growth Slows to 5.5% in Q3 2025 Amid Industry Weakness

Ghana’s economy expanded by 5.5% year-on-year in Q3 2025, down from a revised 6.5% in Q2, marking the slowest growth since Q3 2024. On a seasonally adjusted basis, GDP rose 1.3% quarter-on-quarter, following a 1.4% increase in the previous quarter.

Ghana Halts Ewoyaa Mining Lease Review to Reassess Mining Code and Royalties

Ghana’s Parliament has temporarily withdrawn Atlantic Lithium’s Mining Lease for the Ewoyaa Lithium Project to allow further consultation on the country’s mining code and royalty structure.

Fitch Warns of Downside Risks to Ghana’s Growth Amid Gold Price Volatility and Security Threats

Fitch warns Ghana’s outlook faces risks from potential gold price corrections and Sahel insurgency spillovers. Sharp drops in gold could strain reserves, weaken the cedi, and push inflation higher, while security threats may divert funds or raise borrowing, slowing growth.

Ghana Gold Coin Pricing Update

1 oz Now Selling at GH₵50,189.02 with 0.50 oz at GH₵25,447.87

and 0.25 oz at GH₵13,100.72 as of 12th December 2025. (Bank of Ghana, 2025)

PRIMARY DEBT MARKET ISSUANCE WEEK

Yields on Government of Ghana (GoG) treasury bills posted marginal mixed performance across the tenors last week. The 91-day bill increase marginally by 3 basis points to 11.11%, the 364-day bill by 27 basis points to 12.97%, while the 182-day marginally decreased by 1 basis points, settling at 12.54%.

| Security | Current Wk% | Previous Wk% |

|---|---|---|

| 91-Day GoG Bill | 11.1108 | 11.0826 |

| 182-Day GoG Bill | 12.5421 | 12.5527 |

| 364-Day GoG Bill | 12.9704 | 12.7008 |

Source(s): Bank of Ghana

GHANA FIXED INCOME MARKET VOLUME TRADED

The Ghana Fixed Income Market (GFIM) recorded a total trading volume of GH₵7.19 billion at the week's close, reflecting an increase from the GH₵5.20 billion reported in the previous week. The total number of transactions recorded was 2,621, with Treasury bills dominating the market and accounting for 83.67% of the trades. Meanwhile, New GoG Notes & Bonds posting 10.15% to the total trading activity.

Daily Volume (GHS) Traded – GFIM

Week's Yield Curve

EQUITY MARKET

Trading activity on the local stock exchange turned bullish this week, with total share volume increased by 248% to 26,553,452 shares, from 7,639,440 shares posted the previous week. The total traded value surged by 458%, settling at GH₵46.74million compared to GH₵8.39 million last week, reflecting a significant increase in higher-value transactions. Market capitalization posted a 0.41% weekly marginal gain, closing at GH₵168.50 billion, down from GH₵167.81 billion.

| Indec | Level | WoW% | MoM% | YoY% |

|---|---|---|---|---|

| GSE-CI | 8,679.19 | 0.66 | 0.80 | 77.54 |

| FSI | 4,544.24 | 1.26 | 1.97 | 90.87 |

Source(s): Ghana Stock Exchange

Week's Equities Top Gainers & Laggards

EQUITY MARKET MOST TRADED STOCKS

| Ticker | Traded Volume | Price (GHS) |

|---|---|---|

| CAL | 17,884,307 | 0.47 |

| MTNGH | 7,718,597 | 4.20 |

| SOGEGH | 259,292 | 4.49 |

| SIC | 247,084 | 1.20 |

| ETI | 180,018 | 0.79 |

Source(s): Ghana Stock Exchange

TOP PERFORMING AFRICAN STOCK INDICES YEAR-TO-DATE

| Country | Index | Level | YTD% |

|---|---|---|---|

| Malawi | MSE ASI | 613,095.22 | 256.37 |

| Ghana | GSE-CI | 8,679.19 | 77.54 |

| Tanzania | LuSE ASI | 25,565.89 | 65.57 |

| Nigeria | NGX ASI | 149,433.25 | 45.18 |

| Egypt | EGX 30 | 42,065.20 | 41.44 |

Source(s): African Markets

COMMODITY MARKET

This week, the commodities market posted a mixed performance, driven by notable price fluctuations. Gold prices increased from $4,212.90 to $4,300.10 per troy ounce week-on-week (w/w). The precious metal posted a 2.07% weekly gain.

Meanwhile, Brent crude oil futures posted a 4.13% weekly loss decreasing from $63.75 to $61.12 per barrel, as a supply glut and a potential Russia-Ukraine peace deal outweighed worries about any impact from the U.S. seizure of an oil tanker near Venezuela. Traders and analysts largely shrugged off worries about the impact of the tanker seizure, pointing to ample supply in the markets.

Cocoa futures posted a increase settling at $6,226 per ton from last week’s $5,643, posting a 10.33% weekly gain, extending their sharp two-week-long rally today to 5-week highs. Cocoa prices have rallied sharply over the past two weeks amid a tightening global supply outlook.

Source(s): Yahoo Finance, Trading Economics

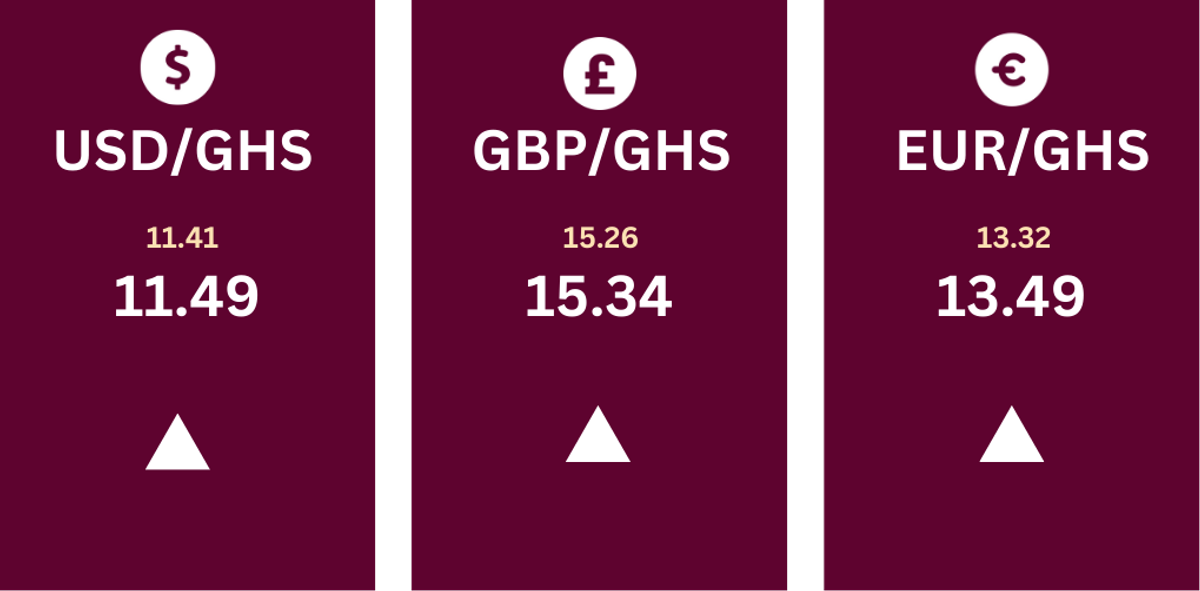

CURRENCY MARKET

The Ghanaian cedi (GH₵) recorded a marginal weak performance against major international currencies last week, reflecting ongoing volatility in the foreign exchange market. The local currency weakened by GH₵0.08 against the US dollar (USD), GH₵0.08 against the British pound (GBP) and GH₵0.17 against the Euro (EUR). These movements highlight marginal but notable shifts across key trading pairs.

Source(s): Bank of Ghana