KEY HEADLINES & INSIGHTS

T-Bill Auction Undersubscribed by 30%

Government raised just over GH¢3bn against a GH¢4.24bn target, with most bids in the 91-day bill.

BoG to impose 5-year credit ban on loan defaulters in sweeping banking reforms

Loan defaulters in Ghana could soon face a five-year ban from accessing credit from any financial institution, under sweeping new measures by the Bank of Ghana (BoG) aimed at reducing the country’s high levels of Non-Performing Loans (NPLs)

Insurance Assets Dip in 2024 as Life Segment Leads Holdings

The insurance industry’s investment assets declined slightly in 2024 amid market volatility and cautious post-DDP positioning, according to the Financial Stability Review. Life insurers dominated with GH₵6.7bn versus GH₵3.1bn for non-life. Shifts toward equities, fixed deposits, and property signal diversification but raise risks, making the NIC’s oversight critical to balancing yield and stability.

Ghana Gold Coin Pricing Update

1 oz Now Selling at GH₵ 37,380.94 with 0.50 oz at GH₵19,032.11

and 0.25 oz at GH₵ 9,879.58 as of 15th August 2025. (Bank of Ghana, 2025)

PRIMARY DEBT MARKET ISSUANCE WEEK

Yields on Government of Ghana (GoG) treasury bills saw marginal decline across all tenors last week. The 91-day bill dipped by 6 basis points to 10.14%, indicating reduction in short-term borrowing costs. Similarly, the 182-day and 364-day bills declined by 2 and 2 basis points, respectively, closing at 12.23 % and 13.09%.

| Security | Current Wk% | Previous Wk% |

|---|---|---|

| 91-Day GoG Bill | 10.1374 | 10.2009 |

| 182-Day GoG Bill | 12.2302 | 12.2540 |

| 364-Day GoG Bill | 13.0865 | 13.1022 |

Source(s): Bank of Ghana

GHANA FIXED INCOME MARKET VOLUME TRADED

The Ghana Fixed Income Market (GFIM) recorded a total trading volume of GH₵5.33 billion at the week's close, reflecting an increase from the GH₵4.07 billion reported in the previous week. The total number of transactions recorded was 2,127, with Treasury bills dominating the market and accounting for 86.60% of the trades. Meanwhile, New Government of Ghana (GoG) Notes and Bonds contributed 7.01% to the total trading activity.

Daily Volume (GHS) Traded - GFIM

Week's Yield Curve

EQUITY MARKET

Trading activity on the local stock exchange turned bullish this week, with total share volume increased by 71% to 18,710,893 shares, down from 10,939,932 shares posted the previous week. The total traded value also increased by 54%, settling at GH₵72.62 million compared to GH₵47.16 million last week, reflecting an increase in high-value transactions. Market capitalization posted a 0.17% weekly gain, closing at GH₵151.08 billion, down from GH₵150.83 billion.

| Index | Level | WoW% | MoM% | YoY% |

|---|---|---|---|---|

| GSE-CI | 7,412.59 | 0.35 | 6.01 | 51.63 |

| FSI | 3,416.11 | 0.22 | -0.32 | 43.49 |

Source(s): Ghana Stock Exchange

Week's Equities Top Gainers & Laggards

EQUITY MARKET MOST TRADED STOCKS

| Ticker | Traded Volume | Price (GHS) |

|---|---|---|

| MTNGH | 17,264,446 | 3.95 |

| CAL | 504,665 | 0.51 |

| ETI | 288,506 | 0.80 |

| SIC | 236,604 | 1.05 |

| RBGH | 233,987 | 1.05 |

Source(s): Ghana Stock Exchange

TOP PERFORMING AFRICAN STOCK INDICES YEAR-TO-DATE

| Country | Index | Level | YTD% |

|---|---|---|---|

| Malawi | MSE ASI | 449,662.23 | ▲ 161.37 |

| Ghana | GSE-CI | 7,412.59 | ▲ 51.63 |

| Tanzania | LuSE ASI | 22,117.05 | ▲ 43.24 |

| Nigeria | NGX ASI | 144,628.20 | ▲ 40.52 |

| Morocco | MASI | 19,845.09 | ▲ 34.33 |

Source(s): African Markets

COMMODITY MARKET

This week, the commodities market posted a bearish performance, driven by notable price fluctuations. Gold prices decreased from $3,439.10 to $3,336 per troy ounce week-on-week (w/w). The precious metal posted a 3% weekly loss.

Meanwhile, Brent crude oil futures posted a 1.11% weekly loss decreasing from $66.59 to $65.85 per barrel, as traders awaited the outcome of talks between US President Donald Trump and Russian President Vladimir Putin, with hopes for a possible ceasefire in Ukraine affecting market sentiment. Growing oil supplies from OPEC+ and the possibility of higher US interest rates contributed to bearish sentiment.

Cocoa futures posted a decrease settling at $8,235 per ton from last week’s $8,526, posting a 3.41% loss. Dealers noted increased hedging activity and profit-taking by short-term speculators following the recent price surge linked to concerns over dry weather in the key producing-region. Following poor weather conditions, top cocoa producer Ivory Coast cut its 2025/26 export contracts by 100,000 tonnes.

Source(s): Yahoo Finance, Trading Economics

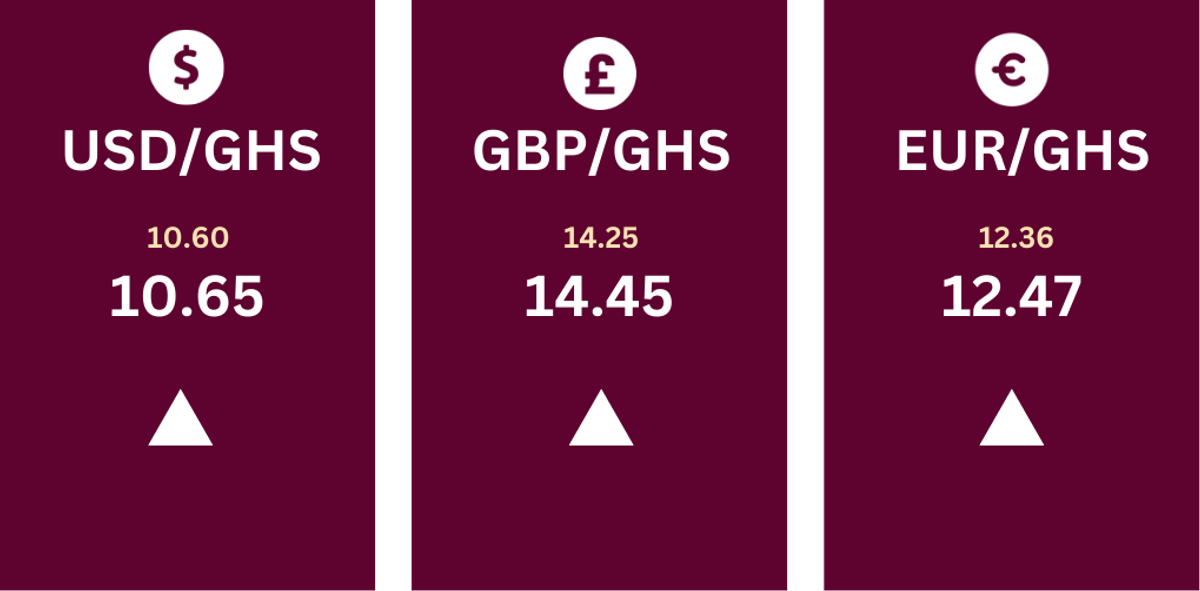

CURRENCY MARKET

The Ghanaian cedi (GH₵) extended weakness against major counterparts over the past week, reflecting sustained pressure in the FX market. The local unit depreciated by GH₵0.05 against the US dollar (USD), GH₵0.20 against the euro (EUR), and GH₵0.11 against the British pound (GBP), underscoring broad-based losses across key trading currencies.

Source(s): Bank of Ghana

DISCLAIMER: The information contained in this weekly update on the financial markets is intended for informational purposes only and should not be construed as financial, investment or other professional advice. The data are derived from internal and external sources that FFC Research finds reliable. FFC Research assumes no responsibility or liability for any actions taken based on the information contained in this report.

Research Analyst - Cedric Asante | Email: cedric.asante@firstfinancecompany.com