KEY HEADLINES & INSIGHTS

Ghana’s T-Bill Auction Sees 96% Oversubscription, Signaling Investor Confidence Rebound

Ghana’s Treasury bill auction saw a strong revival last week, with bids reaching GHS 20.98 billion—nearly 96% above the target. The government accepted GHS 10.64 billion, comfortably covering its GHS 5.44 billion target and upcoming maturities.

Ghana Records GH₵4.14bn Trade Surplus on Soaring Exports

Ghana posted a GH₵4.14 billion trade surplus in the first four months of 2025, fueled by strong cocoa, gold, and oil exports. BoG Governor Dr. Asiama called the 60% export surge a clear sign of renewed trade confidence and economic resilience.

Brent Ends Week Lower Amid Demand, Sanctions Jitters

Brent crude dipped to $69.3, posting a 1.5% weekly loss as mixed U.S. data offset concerns about new EU sanctions on Russian oil. Diesel prices jumped on the refined product ban.

Ghana Gold Coin Pricing Update

1 oz Now Selling at GH₵36,232.12with 0.50 oz at GH₵18,453.77 and 0.25 oz at GH₵9,585.96 as of 11th July 2025. (Bank of Ghana, 2025)

PRIMARY DEBT MARKET ISSUANCE WEEK

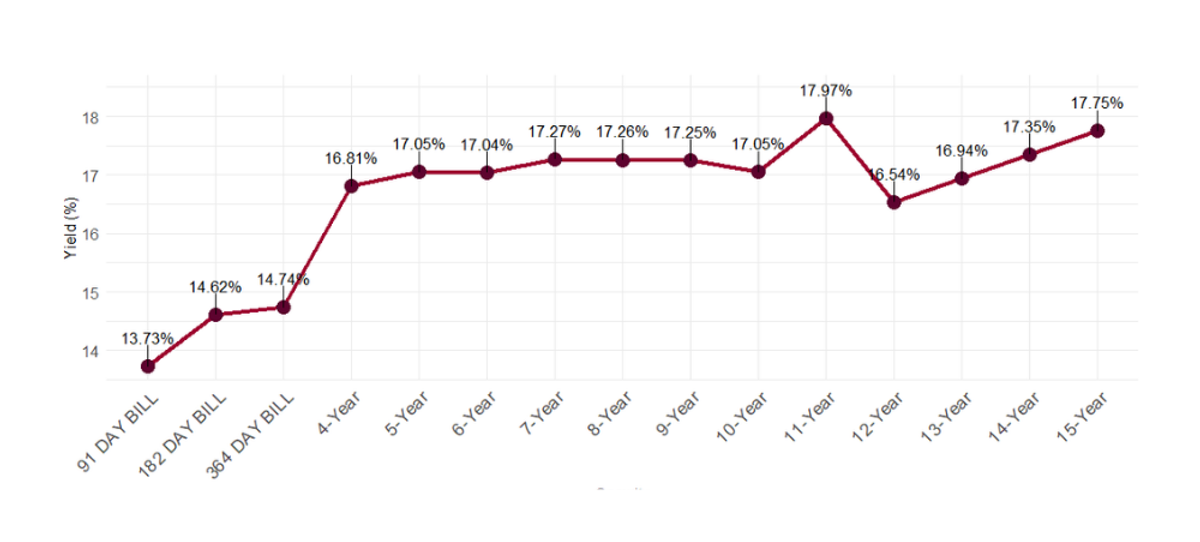

Yields on Government of Ghana (GoG) treasury bills saw significant decline across all tenors last week. The 91-day bill dipped by 93.3 basis points to 13.73%, indicating reduction in short-term borrowing costs. Similarly, the 182-day and 364-day bills declined by 41.25 and 68 basis points, respectively, closing at 14.62 % and 14.74%.

| Security | Current Wk% | Previous Wk% |

|---|---|---|

| 91-Day GoG Bill | 13.7276 | 14.6596 |

| 182-Day GoG Bill | 14.6164 | 15.0289 |

| 364-Day GoG Bill | 14.7393 | 15.4192 |

Source(s): Bank of Ghana

GHANA FIXED INCOME MARKET VOLUME TRADED

The Ghana Fixed Income Market (GFIM) recorded a total trading volume of GH₵4.48 billion at the week's close, reflecting an increase from the GH₵3.32 billion reported in the previous week. The total number of transactions recorded was 2,496, with Treasury bills dominating the market and accounting for 86.06% of the trades. Meanwhile, New Government of Ghana (GoG) Notes and Bonds contributed 10.42% to the total trading activity.

The fixed income market opened the week on a weak note, recording a turnover of GH₵564.5 million, attributed largely to Treasury Bills and largely New Government of Ghana (GoG) Notes & Bonds.

Market liquidity surged to GH₵821.5 million on July 15, reflecting increased participation. Activity surged further to GH₵1,350.9 million on July 16, with trading focused mainly on Treasury securities, Corporate Bonds and New GoG issuances. Turnover dipped to reach GH₵574.2 million on July 17. The week ended on a stronger note, compared to the previous day to reach GH₵1,167.9 million attributed to mainly New GoG Notes & Bonds and Treasury Bills.

Week's Yield Curve

EQUITY MARKET

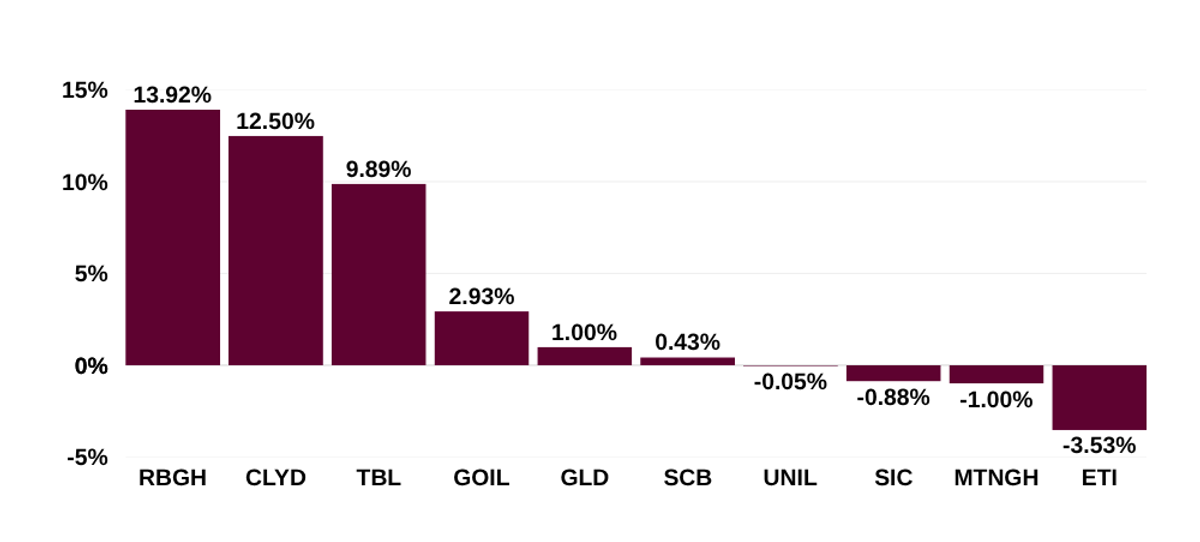

Trading activity on the local stock exchange turned bullish this week, with total share volume increased by 171% to 9,754,240 shares, down from 3,597,193 shares posted the previous week. The total traded value also increased by 143%, settling at GH₵38.32 million compared to GH₵15.76 million last week, reflecting an increase in high-value transactions. Market capitalization posted a marginal weekly loss, closing at GH₵138.6 billion, up from GH₵139.58 billion.

Regarding market indices, the GSE Composite Index (GSE-CI) closed at 6,386.76 showing a 0.59% week-on-week loss, a 2.21% monthly gain, and a substantial year-to-date gain of 30.65%.

Week's Equities Top Gainers & Laggards

Moreover, the GSE Financial Stocks Index (GSE-FSI) settled at 3,417.71 points, making it a weekly loss of 0.33%, a monthly gain of 1.24%, and a year-to-date gain of 43.55%.

EQUITY MARKET MOST TRADED STOCKS

| Ticker | Traded Volume | Price (GHS) |

|---|---|---|

| MTNGH | 7,900,535 | 2.98 |

| GCB | 1,089,269 | 9.47 |

| ETI | 269,255 | 0.82 |

| SIC | 191,100 | 1.13 |

| CAL | 137,233 | 0.55 |

Source(s): Ghana Stock Exchange

TOP PERFORMAING AFRICAN STOCK INDICES YEAR-TO-DATE

| Country | Index | Level | YTD% |

|---|---|---|---|

| Malawi | MSE ASI | 367,465.79 | ▲ 113.59 |

| Tanzania | LuSE ASI | 20,943.18 | ▲ 35.63 |

| Ghana | GSE-CI | 6,386.76 | ▲ 30.65 |

| Morocco | MASI | 19,168.83 | ▲ 29.75 |

| Kenya | NSE ASI | 157.93 | ▲ 27.90 |

Source(s): African Markets

COMMODITY MARKET

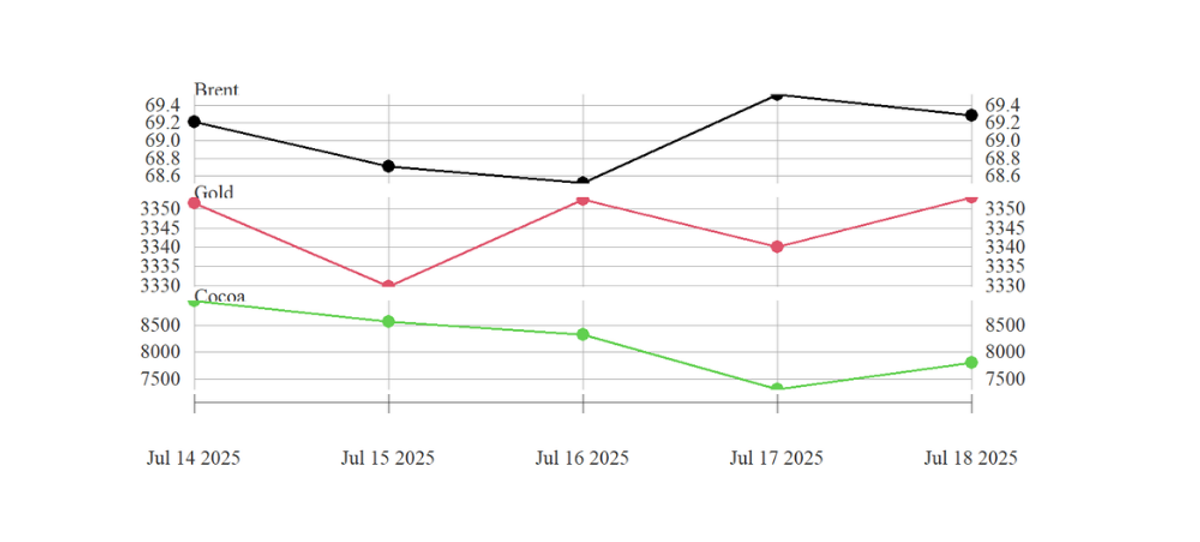

This week, the commodities market posted mixed performance, driven by notable price fluctuations. Gold prices decrease marginally from $3,356 to $3,353.06 per troy ounce week-on-week (w/w). The precious metal posted a 0.1% weekly loss.

Meanwhile, Brent crude oil futures posted a 1.53% weekly loss decreasing from $70.36 to $69.28 per barrel, as mixed US economic data offset concerns about new EU sanctions on Russian energy exports. The EU approved its 18th sanctions package targeting Russia’s oil industry, including a new floating price cap and a ban on petroleum products made from Russian crude.

Cocoa futures posted a decline settling at $7,800 per ton from last week’s $8,840, posting a 11.76% loss, pressured by weaker second-quarter demand data from Asia, Europe, and North America. Global cocoa demand declined across all major regions in Q2 2025, with Asia experiencing the sharpest drop at 16.3%, followed by Europe at 7.2%, and North America at 2.78%, largely due to high cocoa prices, supply chain issues, and cost pressures.

CURRENCY MARKET

The Ghanaian Cedi (GHS) has shown mixed performance against major foreign currencies compared to the previous week. Specifically, it has lost GHS0.03 against the US Dollar (USD), gained GHS0.03 against the British Pound (GBP), and gained GHS0.01 against the Euro (EUR), compared to the previous week.

Source(s): Bank of Ghana