KEY HEADLINES & INSIGHTS

Ghana is preparing to re-enter the domestic bond market for the first time since its 2022 debt default. Government aims to raise GH¢3 billion through the issuance of medium-term bonds between September and December 2025. (Bloomberg, 2025)

Brent crude oil futures recorded a sharp 12% weekly decline, falling from $77.01 to $67.77 per barrel, driven by easing geopolitical tensions in the Middle East and growing expectations that OPEC+ may further raise production.

Republic Bank (Ghana) PLC has announced a significant turnaround in its financial performance for the year ended 31st December 2024, closing the year with a total comprehensive income of GHS210.68 million, representing a 45% year-on-year increase. (Ghana Stock Exchange, 2025)

Ghana Gold Coin Pricing Update: 1 oz Now Selling at GH₵ 35,930.42 with 0.50 oz at GH₵18,301.56 and 0.25 oz at GH₵ 9,508.31 as of 27th June 2025. (Bank of Ghana, 2025)

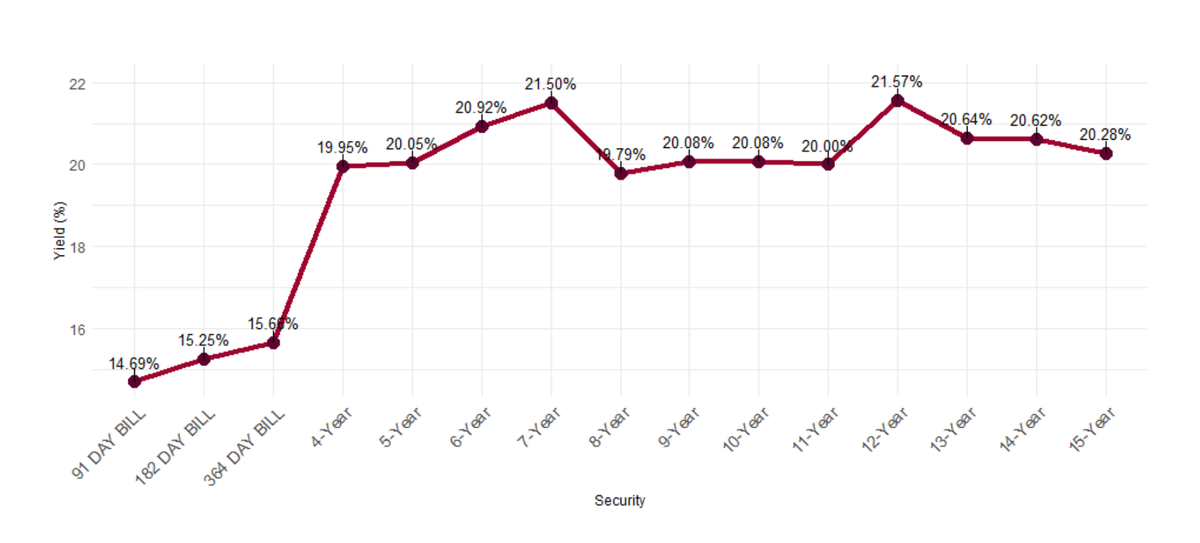

PRIMARY DEBT MARKET ISSUANCE WEEK

Yields on Government of Ghana (GoG) treasury bills saw a marginal decline across all tenors last week. The 91-day bill fell by 0.38 basis points to 14.69%, indicating relative stability in short-term borrowing costs. Similarly, the 182-day and 364-day bills dropped by 0.34 and 3.72 basis points, respectively, closing at 15.25% and 15.66%. This decline reflects a moderation in GoG’s borrowing costs amid ongoing macroeconomic reforms.

| Security | Current Wk % | Previous WK % |

|---|---|---|

| 91-Day GoG Bill | 14.6938 | 14.6976 |

| 182-Day GoG Bill | 15.2506 | 15.254 |

| 364-Day GoG Bill | 15.6564 | 15.6936 |

Source(s): Bank of Ghana

GHANA FIXED INCOME MARKET VOLUME TRADED

The Ghana Fixed Income Market (GFIM) recorded a total trading volume of GH₵2.07 billion at the week's close, reflecting decrease from the GH₵2.59 billion reported in the previous week. The total number of transactions recorded was 1,396, with Treasury bills dominating the market and accounting for 87.97% of the trades. Meanwhile, New Government of Ghana (GoG) Notes and Bonds contributed 10.6% to the total trading activity.

The fixed income market opened the week on a strong note, recording a turnover of GH₵606.6 million, attributed largely to Treasury Bills and New Government of Ghana (GoG) Notes & Bonds.

Market liquidity dipped to GH₵157.4 million on June 24, reflecting lower participation. However, activity rebounded to GH₵441.8 million on June 25, with trading focused mainly on Treasury securities and new GoG issuances. Turnover increased further to reach GH₵533.6 million on June 26. The week ended on a slightly weaker note, compared to the previous day to reach GH₵331.1.

Week's Yield Curve

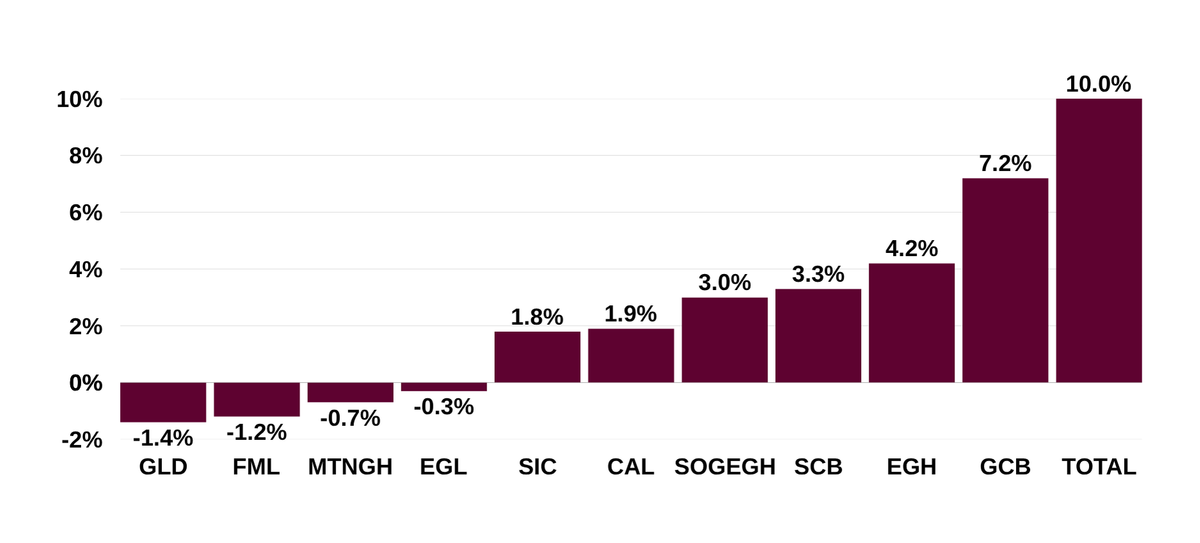

EQUITY MARKET

Trading activity on the local stock exchange turned bearish this week, with total share volume decreased by 2.01% to 5,785,849 shares, down from 5,904,756 shares posted the previous week. The total traded value also decreased by 22%, settling at GH₵21.81 million compared to GH₵27.82 million last week, reflecting a decrease in high-value transactions. Market capitalization posted a marginal weekly gain, closing at GH₵137.30 billion, down from GH₵136.84 billion.

Regarding market indices, the GSE Composite Index (GSE-CI) closed at 6,248.48 showing a 0.62% week-on-week gain, a 1.60% monthly gain, and a substantial year-to-date gain of 27.82%.

Week's Equities Top Gainers & Laggards

Moreover, the GSE Financial Stocks Index (GSE-FSI) increased to 3,376.01 points, making it a weekly gain of 1.58%, a monthly gain of 4.94%, and a year-to-date gain of 41.80%.

EQUITY MARKET MOST TRADED STOCKS

| Ticker | Traded Volume | Price (GHS) |

|---|---|---|

| MTNGH | 4,735,241 | 2.93 |

| GCB | 264,810 | 10.00 |

| ETI | 238,744 | 0.85 |

| FML | 138,182 | 4.10 |

| EGL | 106,955 | 2.85 |

Source(s): Ghana Stock Exchange

TOP PERFORMING AFRICAN STOCK INDICES YEAR-TO-DATE

| Country | Index | Level | YTD% |

|---|---|---|---|

| Malawi | MSE ASI | 319,540.44 | ▲ 33.20 |

| Tanzania | LuSE ASI | 20,567.22 | ▲ 33.20 |

| Ghana | GSE-CI | 6,248.48 | ▲ 27.82 |

| Nigeria | NSE ASI | 152.45 | ▲ 23.46 |

| Nigeria | NGX ASI | 119,995.76 | ▲ 16.58 |

Source(s): African Markets

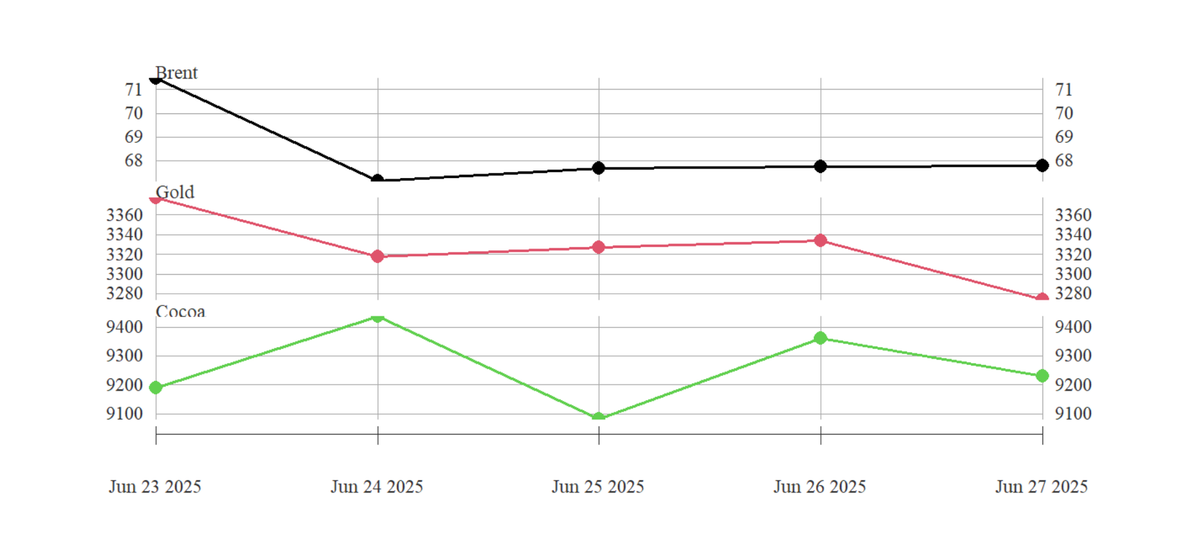

COMMODITY MARKET

This week, the commodities market posted mixed performance, driven by notable price fluctuations. Gold prices declined from $3,273.7 to $3,368.10 per troy ounce week-on-week (w/w). The precious metal posted a 2.8% weekly loss.

Meanwhile, Brent crude oil futures posted a 12% weekly loss decreasing from $77.01 to $67.77 per barrel, amid easing tensions in the Middle East and the possibility that OPEC+ will further increase its oil output. The Israel-Iran truce continues to hold, alleviating fears of a broader conflict that could disrupt crude flows from the region.

Cocoa futures declined this week, marginal increase to $9,231.00 per ton from last week’s $8,459, posting a 9.13% gain. This is up from recent two-month lows, as traders remained focused on the outlook for the next main crop in top grower Ivory Coast.

Source(s): Yahoo Finance, Trading Economics

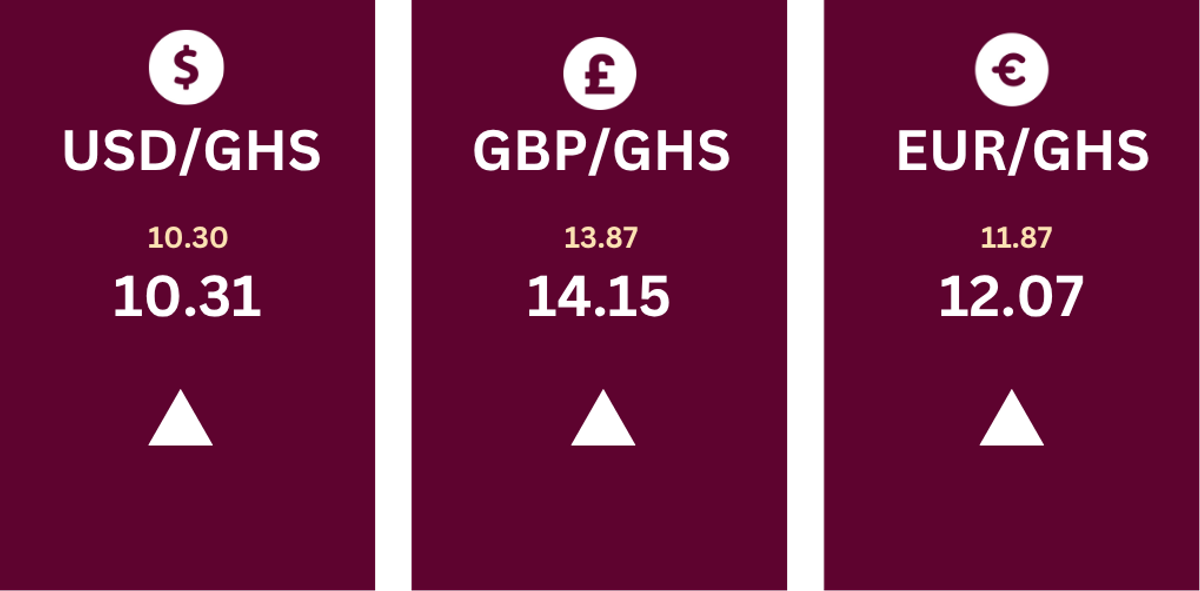

CURRENCY MARKET

The Ghanaian Cedi (GHS) has shown slight depreciation against major foreign currencies compared to the previous week. Specifically, it has lost GHS0.01 against the US Dollar (USD), lost GHS0.28 against the British Pound (GBP), and lost GHS0.20 against the Euro (EUR), compared to the previous week.

Source(s): Bank of Ghana

DISCLAIMER: The information contained in this weekly update on the financial markets is intended for informational purposes only and should not be construed as financial, investment or other professional advice. The data are derived from internal and external sources that FFC Research finds reliable. FFC Research assumes no responsibility or liability for any actions taken based on the information contained in this report.

Research Analyst - Cedric Asante | Email: cedric.asante@firstfinancecompany.com