KEY HEADLINES & INSIGHTS

Treasury Bills Undersubscribed Again as Investor Appetite Weakens

Ghana’s latest Treasury bill auction raised GH¢3.39bn, falling short of the GH¢6.72bn target. Weak demand persisted across all maturities despite slight yield declines—91-day at 10.32%, 182-day at 12.37%, and 364-day at 12.99%. Government now targets GH¢3.78bn in the next auction.

BoG Puts Digital Credit Services under Regulation

The Bank of Ghana has formally designated digital credit services as a non-bank financial service, bringing the financial sector’s fast-expanding segment under regulatory oversight.

Ghana Sees Strong Investor Confidence Despite Global FDI Slowdown

The Ghana Investment Promotion Centre’s Q4-2024 report shows $617.61 million in foreign direct investment (FDI) and $34.11 million in local investment. While total inflows dipped compared to 2023, investor appetite improved with 140 registered projects—an 11% rise year-on-year. Notably, 107 of these were wholly foreign-owned, underscoring sustained global confidence in Ghana’s economy despite global FDI contractions.

Ghana Gold Coin Pricing Update

1 oz Now Selling at GH₵40,488.70 with 0.50 oz at GH₵20,596.57

and 0.25 oz at GH₵10,673.79 as of 29th August 2025. (Bank of Ghana, 2025)

PRIMARY DEBT MARKET ISSUANCE WEEK

Yields on Government of Ghana (GoG) treasury bills saw marginal decline across all tenors last week. The 91-day bill dipped by 9 basis points to 10.33%, indicating reduction in short-term borrowing costs. Similarly, the 182-day and 364-day bills declined by 1.4 and 0.6 basis points, respectively, closing at 12.37% and 12.99%.

| Security | Current Wk% | Previous Wk% |

|---|---|---|

| 91-Day GoG Bill | 10.3265 | 10.4197 |

| 182-Day GoG Bill | 12.3724 | 12.3861 |

| 364-Day GoG Bill | 12.9985 | 13.0043 |

Source(s): Bank of Ghana

GHANA FIXED INCOME MARKET VOLUME TRADED

The Ghana Fixed Income Market (GFIM) recorded a total trading volume of GH₵5.57 billion at the week's close, reflecting a decrease from the GH₵5.33 billion reported in the previous week. The total number of transactions recorded was 5,646, with Treasury bills dominating the market and accounting for 96.05% of the trades. Meanwhile, New Government of Ghana (GoG) Notes and Bonds contributed 1.95% to the total trading activity.

Daily Volume (GHS) Traded - GFIM

Week's Yield Curve

EQUITY MARKET

Trading activity on the local stock exchange turned bearish this week, with total share volume decreased by 83% to 2,155,384 shares, down from 12,982,577 shares posted the previous week. The total traded value also decreased by 67%, settling at GH₵15.51 million compared to GH₵47.11 million last week, reflecting a decrease in high-value transactions. Market capitalization posted a 0.20% weekly loss, closing at GH₵149.60 billion, down from GH₵149.90 billion.

| Index | Level | WoW% | MoM% | YoY% |

|---|---|---|---|---|

| GSE-CI | 7,330.37 | -0.22 | 4.484 | 49.95 |

| FSI | 3,411.96 | -0.07 | -0.44 | 43.31 |

Source(s): Ghana Stock Exchange

Weekly Gainers & Laggards

EQUITY MARKET MOST TRADED STOCKS

| Ticker | Traded Volume | Price (GHS) |

|---|---|---|

| MTNGH | 768,180 | 3.87 |

| CAL | 402,796 | 0.51 |

| SIC | 305,001 | 1.05 |

| ETI | 243,742 | 0.77 |

| IIL | 126,311 | 0.05 |

Week's Equities Top Gainers & Laggards

TOP PERFORMING AFRICAN STOCK INDICES YEAR-TO-DATE

| Country | Index | Level | YTD% |

|---|---|---|---|

| Malawi | MSE ASI | 535,303.19 | 211.15 |

| Tanzania | LuSE ASI | 24,172.67 | 56.55 |

| Ghana | GSE-CI | 7,330.37 | 49.95 |

| Kenya | NSE ASI | 172.6 | 39.78 |

| Nigeria | NGX ASI | 140,295.49 | 36.31 |

Source(s): African Markets

COMMODITY MARKET

This week, the commodities market posted a mixed performance, driven by notable price fluctuations. Gold prices increased from $3374.4 to $3473.7 per troy ounce week-on-week (w/w). The precious metal posted a 2.94% weekly gain.

Meanwhile, Brent crude oil futures posted a 0.06% weekly marginal gain increasing from $67.7 to $68.12 per barrel, as traders looked toward weaker demand in the U.S., the world's largest oil market, and a boost in supply this autumn from OPEC and its allies. The group has accelerated output hikes to regain market share, raising the supply outlook and weighing on global oil prices.

Cocoa futures posted a decrease settling at $7,635 per ton from last week’s $7,582, posting a 0.70% gain. amid concerns that high cocoa prices and tariffs could dampen chocolate demand. Weakness in chocolate demand is a negative factor for cocoa prices.

Source(s): Yahoo Finance, Trading Economics

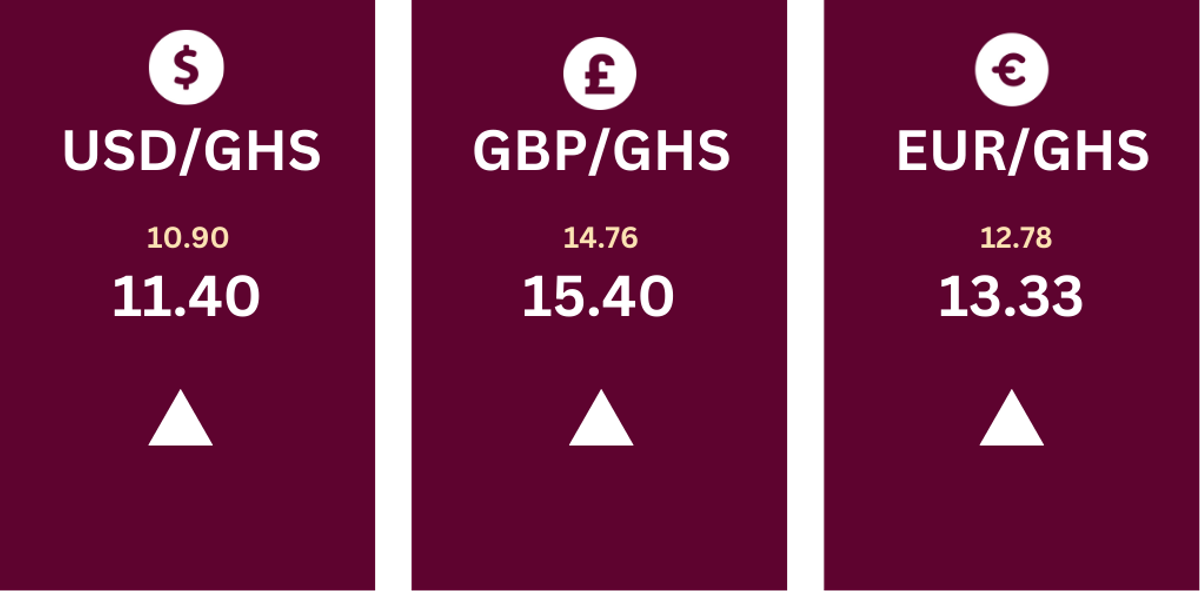

CURRENCY MARKET

The Ghanaian cedi (GH₵) extended weakness against major counterparts over the past week, reflecting sustained pressure in the FX market. The local unit depreciated by GH₵0.50 against the US dollar (USD), GH₵0.55 against the euro (EUR), and GH₵0.64 against the British pound (GBP), underscoring broad-based losses across key trading currencies.

Source(s): Bank of Ghana