KEY HEADLINES & INSIGHTS

Ghana’s Inflation Slows to 9.4% in September, Lowest Since August 2021

Ghana’s annual inflation fell to 9.4% in September 2025, its lowest since August 2021 and the ninth straight monthly decline. The drop was driven by easing food prices (11% from 14.8%) and imported inflation (7.4% from 9.5%), aided by a relatively stable cedi. Inflation remains above the Bank of Ghana’s 6–10% target band.

Ghana Stock Exchange rises to highest level in 2025

The Ghana Stock Exchange extended its strong momentum last week, with the benchmark GSE Composite Index gaining 3.58% to close at 8,410.56, bringing its year-to-date return to 72.05%

Guinness Ghana FY2025 — Record Growth & Ownership Shift

Guinness Ghana posted its strongest results ever, with revenue up 52% to GH¢3.59B and operating profit rising 448%. The company declared a GH¢0.098 dividend—the highest in 7 years—and expanded its beer market share beyond 50%.

Ghana Gold Coin Pricing Update

1 oz Now Selling at GH₵50,376.94 with 0.50 oz at GH₵25,558.08

and 0.25 oz at GH₵13,174.22 as of 3rd October 2025. (Bank of Ghana, 2025)

PRIMARY DEBT MARKET ISSUANCE WEEK

Yields on Government of Ghana (GoG) treasury bills showed marginal decrease across the tenors last week. The 91-day bill rose by 3 basis points to 10.47%, while the 182-day bill declined by 4 basis points to 12.35%. The 364-day bill marginally decreased by 3 basis points, settling at 12.87%.

| Security | Current Wk% | Previous Wk% |

|---|---|---|

| 91-Day GoG Bill | 10.4739 | 10.5048 |

| 182-Day GoG Bill | 12.3516 | 12.3922 |

| 364-Day GoG Bill | 12.8707 | 12.8994 |

Source(s): Bank of Ghana

GHANA FIXED INCOME MARKET VOLUME TRADED

The Ghana Fixed Income Market (GFIM) recorded a total trading volume of GH₵6.99 billion at the week's close, reflecting an increase from the GH₵5.80 billion reported in the previous week. The total number of transactions recorded was 6,048, with Treasury bills dominating the market and accounting for 95.09% of the trades. Meanwhile, New Government of Ghana (GoG) Notes and Bonds contributed 2.51% to the total trading activity.

Daily Volume (GHS) Traded - GFIM

Week's Yield Curve

EQUITY MARKET

Trading activity on the local stock exchange turned bearish this week, with total share volume decreased by 12.14% to 6,722,522 shares, from 7,651,661 shares posted the previous week. The total traded value, however, decreased by 27%, settling at GH₵27.39 million compared to GH₵37.46 million last week, reflecting a decrease in high-value transactions. Market capitalization posted a 2.36% weekly gain, closing at GH₵165.63 billion, down from GH₵161.82 billion.

| Index | Level | WoW% | MoM% | YoY% |

|---|---|---|---|---|

| GSE-CI | 8,410.56 | 3.58 | 2.97 | 72.05 |

| FSI | 3,880.46 | 3.44 | 2.14 | 62.99 |

Source(s): Ghana Stock Exchange

Week's Equities Top Gainers & Laggards

EQUITY MARKET MOST TRADED STOCKS

| Ticker | Traded Volume | Price (GHS) |

|---|---|---|

| MTNGH | 4,856,198 | 4.52 |

| ETI | 636,310 | 0.91 |

| SIC | 392,413 | 1.05 |

| CAL | 275,902 | 0.69 |

| FML | 237,978 | 5.45 |

Source(s): Ghana Stock Exchange

TOP PERFORMING AFRICAN STOCK INDICES YEAR-TO-DATE

| Country | Index | Level | YTD% |

|---|---|---|---|

| Malawi | MSE ASI | 600,469.03 | 249.03 |

| Ghana | GSE-CI | 8,410.56 | 72.05 |

| Tanzania | LuSE ASI | 25,276.85 | 63.7 |

| Kenya | NSE ASI | 178.5 | 44.56 |

| Nigeria | NGX ASI | 143,584.04 | 39.5 |

Source(s): African Markets

COMMODITY MARKET

This week, the commodities market posted a mixed performance, driven by notable price fluctuations. Gold prices increased from $3,775.3 to $3,880.80 per troy ounce week-on-week (w/w). The precious metal posted a 2.8% weekly gain.

Meanwhile, Brent crude oil futures posted an 8% weekly loss decreasing from $70.13 to $64.53 per barrel. Despite these geopolitical risks, oil prices have slipped over the past four days, with expectations that OPEC+ may accelerate supply hikes adding pressure.

Cocoa futures posted a decrease settling at $7,243 per ton from last week’s $6,190, posting a 10.4% weekly loss. Cocoa prices are selling off as this week's actions by the governments of the Ivory Coast and Ghana to boost the amount they pay farmers for their cocoa beans may encourage sales and boost cocoa supplies.

Source(s): Yahoo Finance, Trading Economics

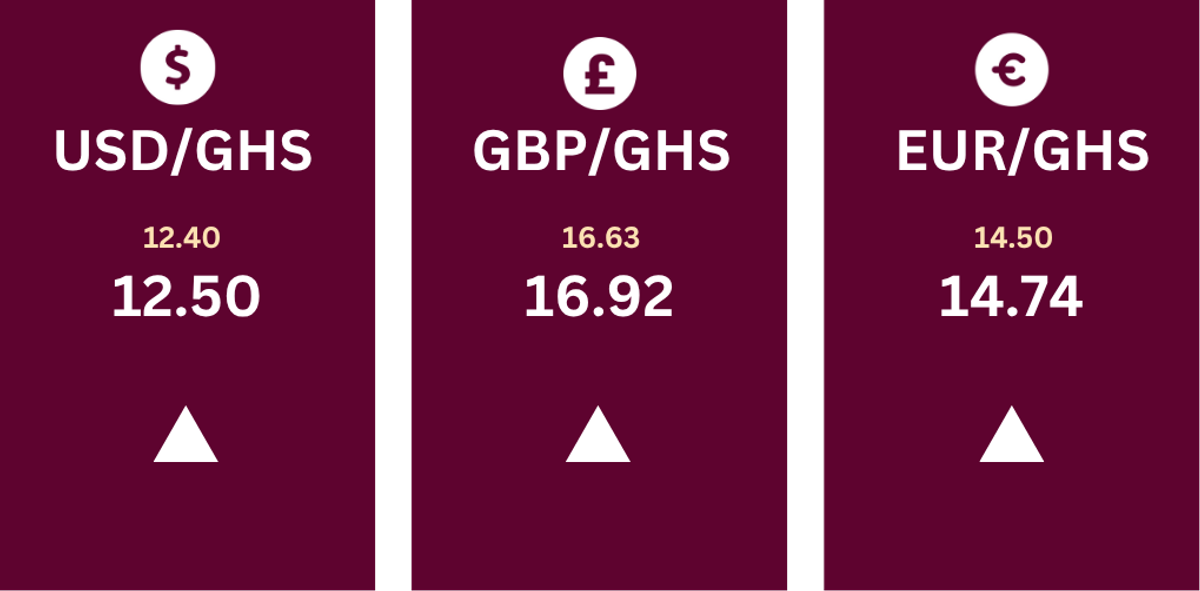

CURRENCY MARKET

The Ghanaian cedi (GH₵) extended weakness against major counterparts over the past week, reflecting sustained pressure in the FX market. The local unit depreciated by GH₵0.10 against the US dollar (USD), GH₵0.24 against the euro (EUR), and GH₵0.29 against the British pound (GBP), underscoring broad-based losses across key trading currencies.