KEY HEADLINES & INSIGHTS

T-Bill Yields Rise Amid GH¢2.33bn Auction Shortfall

Ghana raised GH¢4.49bn in T-bills last week, missing its GH¢6.83bn target by 33%. Yields rose slightly across all maturities, but investor demand stayed weak due to more attractive alternatives. The next auction aims to raise GH¢5.68bn.

Cedi to See Mild Q4 Dip After Strong Gains – Fitch

The Ghana cedi, up over 29% against the dollar in 2025, is expected to weaken slightly by about 8% in Q4 but end the year positive. Fitch forecasts stability for most Sub-Saharan currencies, with the cedi settling near GH¢11.70 per dollar by end-2026.

S&P Upgrades Ghana’s Credit Rating to B-/B with Stable Outlook

Ghana’s foreign and local currency ratings were raised to ‘B-/B’ from ‘CCC+/C’ with a stable outlook, following improved reserves of nearly $11bn and steps toward fiscal discipline. Inflation is forecast to stay below 10% in 2026, but risks remain from commodity price swings and reform implementation.

Ghana Gold Coin Pricing Update

1 oz Now Selling at GH₵45,096.28 with 0.50 oz at GH₵22,892.92

and 0.25 oz at GH₵11,813.53 as of 7th November 2025. (Bank of Ghana, 2025)

PRIMARY DEBT MARKET ISSUANCE WEEK

Yields on Government of Ghana (GoG) treasury bills posted marginal increase across the tenors last week. The 91-day bill increased marginally by 11 basis points to 10.93%, the 182-day bill by 11 basis points to 12.61%, while the 364-day marginally increased by 7 basis points, settling at 13.02%.

| Security | Current Wk% | Previous Wk% |

|---|---|---|

| 91-Day GoG Bill | 10.9277 | 10.8158 |

| 182-Day GoG Bill | 12.6114 | 12.4970 |

| 364-Day GoG Bill | 13.0184 | 12.9517 |

Source(s): Bank of Ghana

GHANA FIXED INCOME MARKET VOLUME TRADED

The Ghana Fixed Income Market (GFIM) recorded a total trading volume of GH₵1.55 billion at the week's close, reflecting a decrease from the GH₵2.65 billion reported in the previous week. The total number of transactions recorded was 1,020, with Treasury bills dominating the market and accounting for 87.06% of the trades. Meanwhile, New Government of Ghana (GoG) Notes and Bonds contributed 6.18% to the total trading activity.

Daily Volume (GHS) Traded - GFIM

Week's Yield Curve

EQUITY MARKET

Trading activity on the local stock exchange turned bearish this week, with total share volume decreased by 48% to 5,471,355 shares, from 10,527,983 shares posted the previous week. The total traded value decreased by 52%, settling at GH₵19.54 million compared to GH₵40.65 million last week, reflecting a significant decrease in higher-value transactions. Market capitalization posted a 1.98% weekly loss, closing at GH₵163.23 billion, up from GH₵166.54 billion.

| Index | Level | WoW% | MoM% | YoY% |

|---|---|---|---|---|

| GSE-CI | 8,229.16 | -1.86 | -1.86 | 68.34 |

| FSI | 4,188.68 | -0.12 | -0.12 | 75.94 |

Source(s): Ghana Stock Exchange

Week's Equities Top Gainers & Laggards

EQUITY MARKET MOST TRADED STOCKS

| Ticker | Traded Volume | Price (GHS) |

|---|---|---|

| MTNGH | 4,098,374 | 4.16 |

| CAL | 677,185 | 0.40 |

| ETI | 199,514 | 0.90 |

| SOGEGH | 117,485 | 4.10 |

| SIC | 68,031 | 1.20 |

Source(s): Ghana Stock Exchange

TOP PERFORMING AFRICAN STOCK INDICES YEAR-TO-DATE

| Country | Index | Level | YTD% |

|---|---|---|---|

| Malawi | MSE ASI | 613,961.24 | 256.87 |

| Ghana | GSE-CI | 8,229.16 | 68.34 |

| Tanzania | LuSE ASI | 25,375.64 | 64.34 |

| Kenya | NSE ASI | 192.07 | 55.55 |

| Nigeria | NGX ASI | 149,524.81 | 45.27 |

Source(s): African Markets

COMMODITY MARKET

This week, the commodities market posted a mixed performance, driven by notable price fluctuations. Gold prices decreased from $3,982.20 to $3,999.40 per troy ounce week-on-week (w/w). The precious metal posted a 0.43% weekly gain.

Meanwhile, Brent crude oil futures posted a 2.21% weekly loss decreasing from $65.07 to $63.63 per barrel, down for a second straight week, as major global producers increase output. The price drop is driven by a surprise 5.2 million-barrel U.S. inventory build that reignited oversupply fears, IG Markets analyst Tony Sycamore said.

Cocoa futures posted a decline settling at $6,013 per ton from last week’s $6,319, posting a 2.24% weekly loss. Since posting 5-week highs on Tuesday, cocoa prices have retreated amid expectations of a bumper cocoa crop in West Africa. Reports from Ivory Coast cocoa farmers stated that cocoa trees are doing well following favorable weather.

Source(s): Yahoo Finance, Trading Economics

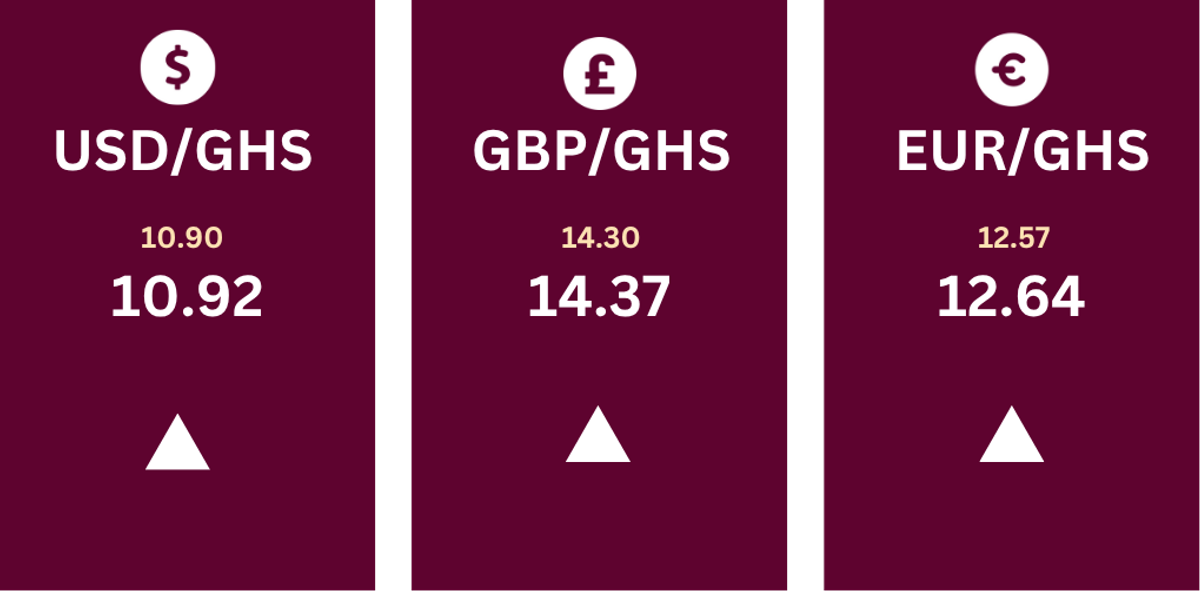

CURRENCY MARKET

The Ghanaian cedi (GH₵) recorded a marginal weak performance against major international currencies last week, reflecting ongoing volatility in the foreign exchange market. The local currency weakened by GH₵0.02 against the US dollar (USD), GH₵0.07 against the euro (EUR) and GH₵0.07 against the British pound (GBP). These movements highlight marginal but notable shifts across key trading pairs.

Source(s): Bank of Ghana